salt tax limit repeal

The 80000 SALT cap amount would also apply to the 2021 tax year. And 25 percent would benefit the top 01.

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Limit Individual Retirement Accounts IRAs contributions when balances reach 10 million and accelerate required minimum distributions for those accounts.

. A staunch Democrat-led coalition in Congress mainly representing high-tax states remains tenacious in advocating for full or partial repeal of the SALT cap. Most recently by voicing opposition to a budget reconciliation package that doesnt provide for lifting the SALT cap or fully restoring the state and local tax deduction altogether. Limit the casualty loss deduction and modify limits on the charitable deduction.

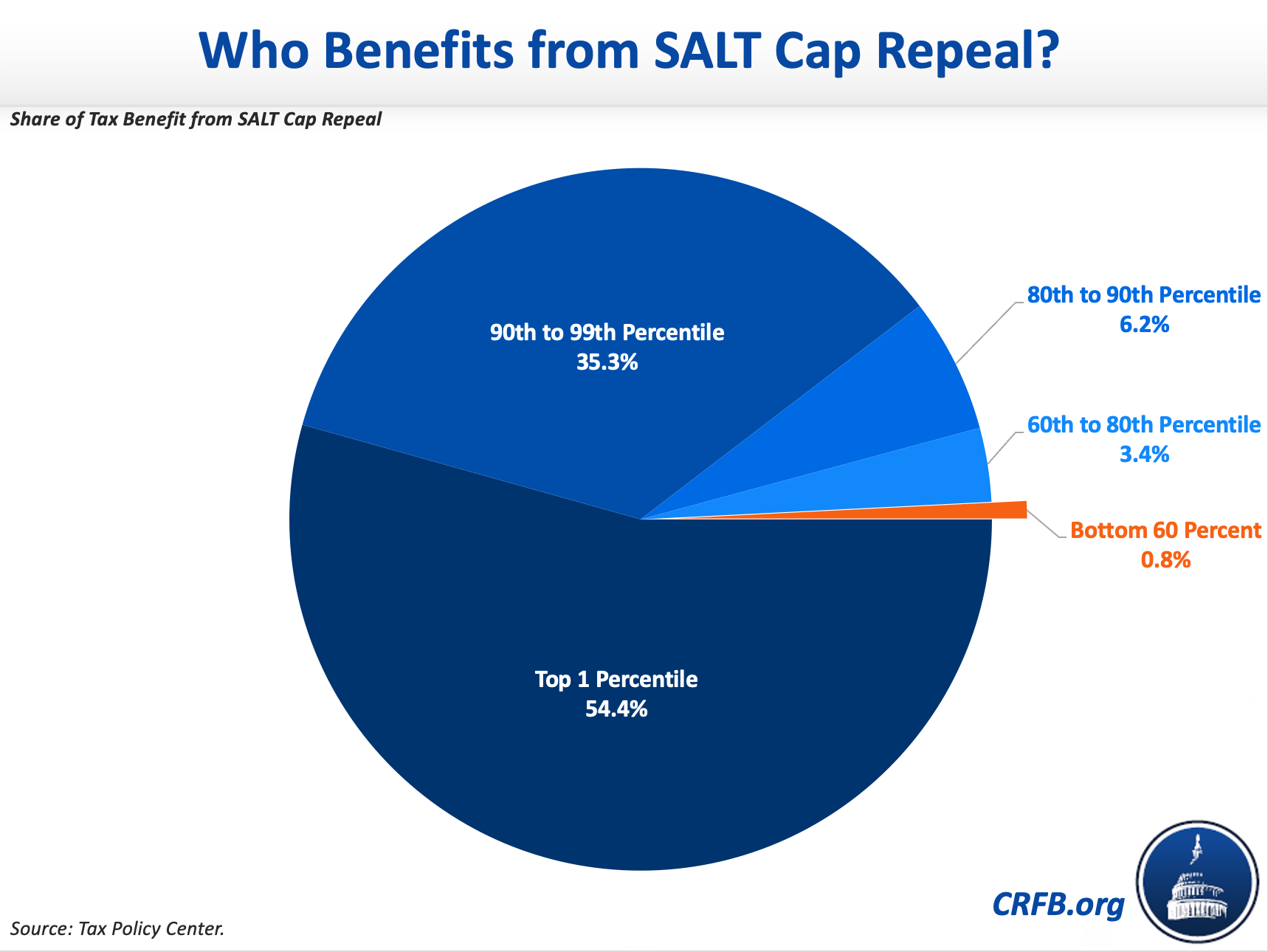

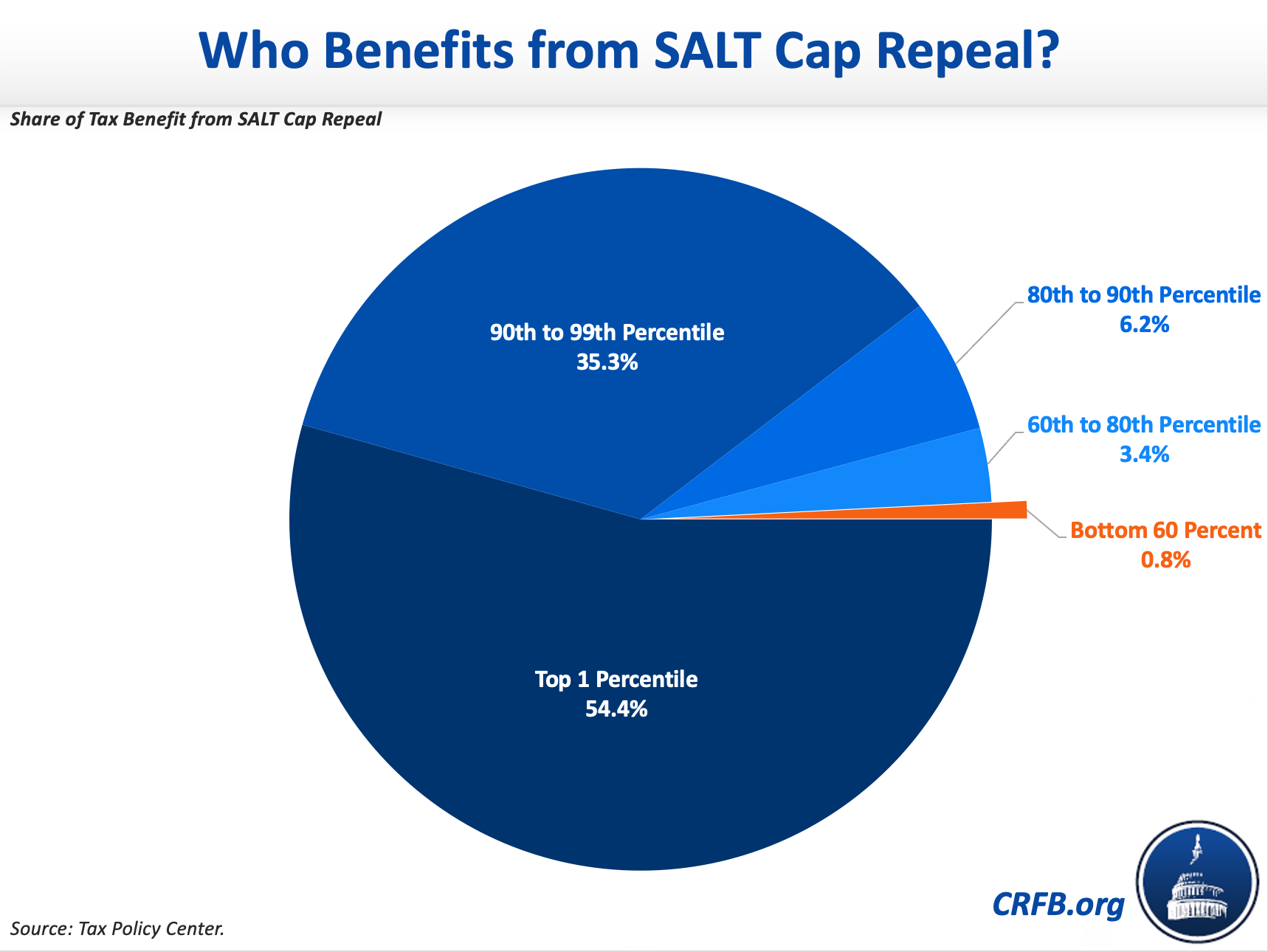

Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion. Nevertheless taxpayers may see the.

Repeal the Pease limitation on itemized deductions. Cap the mortgage interest deduction at 750000 of acquisition debt. Cap the deduction for state and local taxes paid at 10000.

Eliminate several other deductions. The House narrowly passed a measure to repeal the 10000 limit on state and local tax deductions but the legislation is unlikely to survive in the Senate. Blue-state Democrats have been fighting since 2017 to repeal a key provision of President Trumps tax plan that penalized high-cost California filers.

57 percent would benefit the top one percent a cut of 33100. Raise the cap on the state and local tax SALT deduction from 10000 to 80000 and extend this cap through 2030.

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Dems Don T Repeal The Salt Cap Do This Instead Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget